The Carbon Border Adjustment Mechanism (CBAM) involves extending domestic carbon pricing by introducing carbon-related charges on imported products, equivalent to those domestic producers pay. The UK is expected to announce the introduction of its own Carbon Border Adjustment Mechanism, following from the EU.

The UK CBAM (Carbon Border Adjustment Mechanism) is a significant step towards achieving the UK’s decarbonization goals and combating climate change. Like the EU CBAM, unprepared businesses who import or export to the UK could face higher costs and carbon reporting challenges.

Dan Maleski

Environmental Markets Advisor

Connect with me

Want to download our UK

CBAM 101 brochure?

Download our report

What is carbon leakage?

Carbon leakage refers to a situation where businesses or industries move their production (and associated carbon emissions) to regions with less stringent carbon regulations to avoid the higher costs of compliance. This can undermine the effectiveness of emissions reduction measures in one region while increasing emissions in another.

The UK ETS (Emissions Trading System) is a market-based approach to controlling greenhouse gas emissions in the United Kingdom. It sets a cap on the total amount of greenhouse gases that can be emitted by covered industries and allows companies to buy and sell emission allowances. The concern with carbon leakage in the context of the UK ETS is that if businesses face high costs for emissions in the UK, they might relocate their production to areas with less strict regulations, resulting in the transfer of emissions rather than an actual reduction.

The UK ETS (Emissions Trading System) is a market-based approach to controlling greenhouse gas emissions in the United Kingdom. It sets a cap on the total amount of greenhouse gases that can be emitted by covered industries and allows companies to buy and sell emission allowances. The concern with carbon leakage in the context of the UK ETS is that if businesses face high costs for emissions in the UK, they might relocate their production to areas with less strict regulations, resulting in the transfer of emissions rather than an actual reduction.

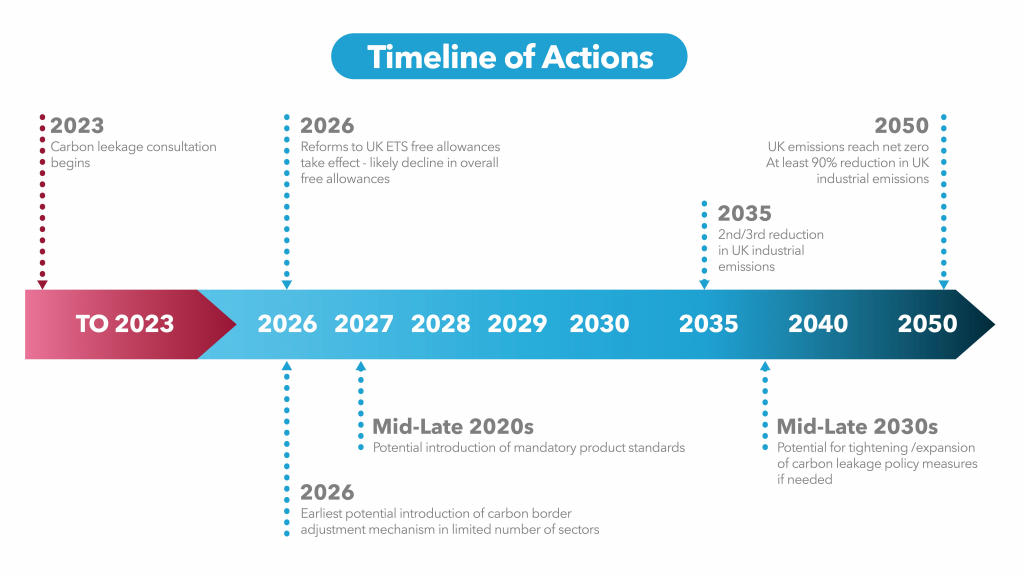

To address this, the UK has historically provided free allowances as a stop-gap temporary measure. However, the UK is currently consulting on three permanent carbon leakage measures. These measures aim to maintain the effectiveness of emission reduction efforts and prevent companies from simply shifting their operations to regions with laxer regulations.

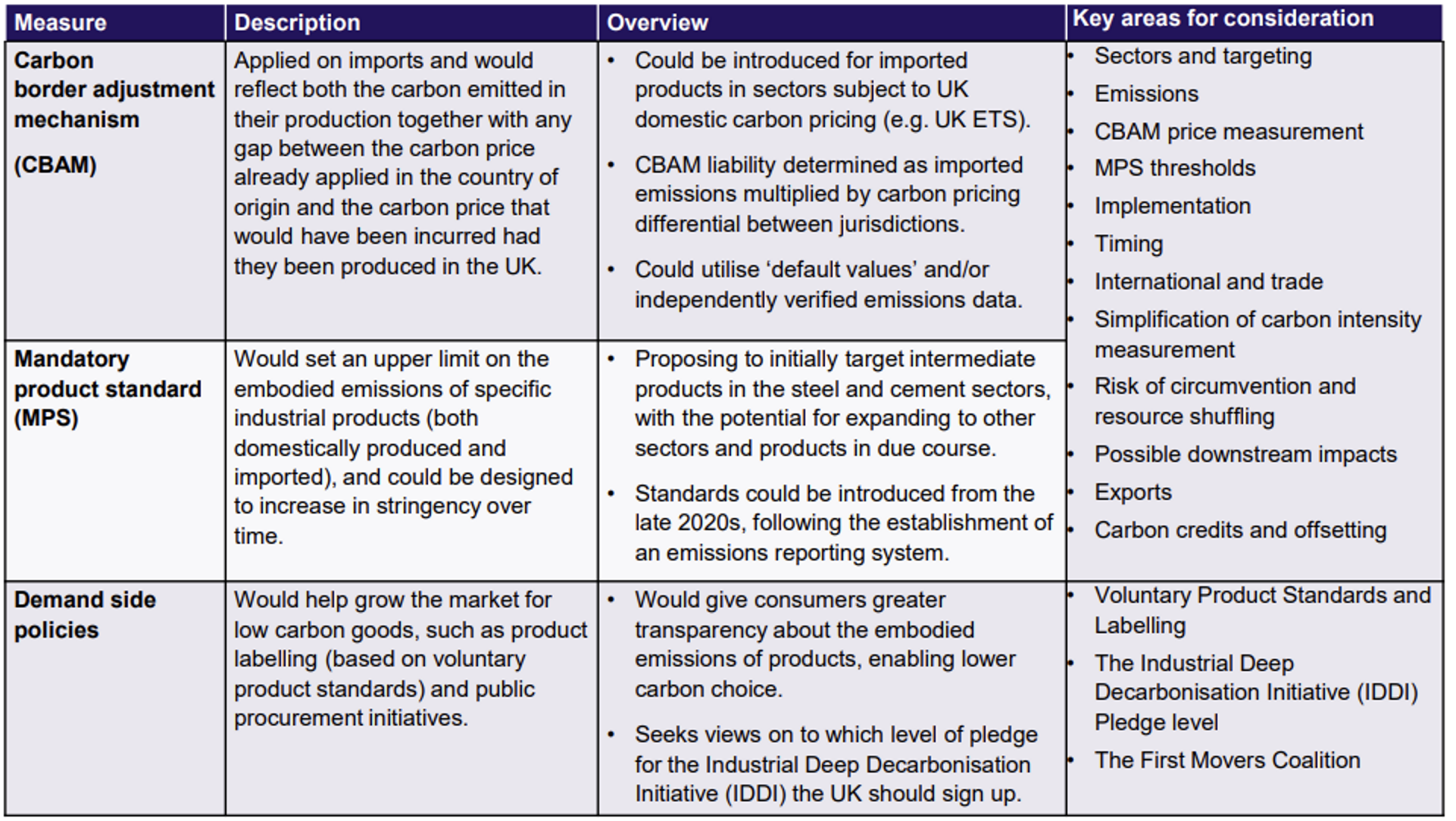

A UK Carbon Border Adjustment Mechanism (CBAM)

A UK CBAM would introduce a carbon price on imported products. This would reflect both the carbon emitted in their production together with any gap between the carbon price applied in the country of origin and the carbon price that would have been incurred had they been produced in the UK.

The sectors under consideration are:

- Cement

- Chemicals

- Glass

- Iron and steel

- Paper & pulp

- Refining

- Fertiliser

- Power generation

- Non-ferrous metals

- Non-metallic minerals

Mandatory product standards (MPS) would set an upper limit on the embodied emissions for individual products placed on the UK market, or produced in the UK, prohibiting products which are more emissions intensive than a defined limit. This could apply to both domestically produced and imported products. The mechanics of an MPS differ from a possible UK CBAM in three key ways:

- MPS allows targeted interventions in specific sectors.

- An MPS does not rely on cost-based incentives but uses product regulations to align with international initiatives.

- An MPS can be applied to sectors beyond the scope of the UK ETS, offering an alternative route to incentivize decarbonization and mitigate carbon leakage risk.

Demand Side Policies:

To mitigate carbon leakage risk and promote decarbonization, additional demand-side policies can be implemented. These may include:

- voluntary product standards

- product labelling

- changes in public procurement guidelines to prioritize low carbon products encouraging private procurers to do the same.

By growing the demand for low carbon goods, businesses could access a green premium for decarbonized products, providing incentives for both UK and overseas businesses to reduce emissions. Such policies also help distinguish low carbon products, reducing the risk of undercutting and displacement by higher carbon alternatives, supporting the growth of low carbon industries globally. International initiatives like the IDDI and the First Movers’ Coalition play a key role in promoting these measures.

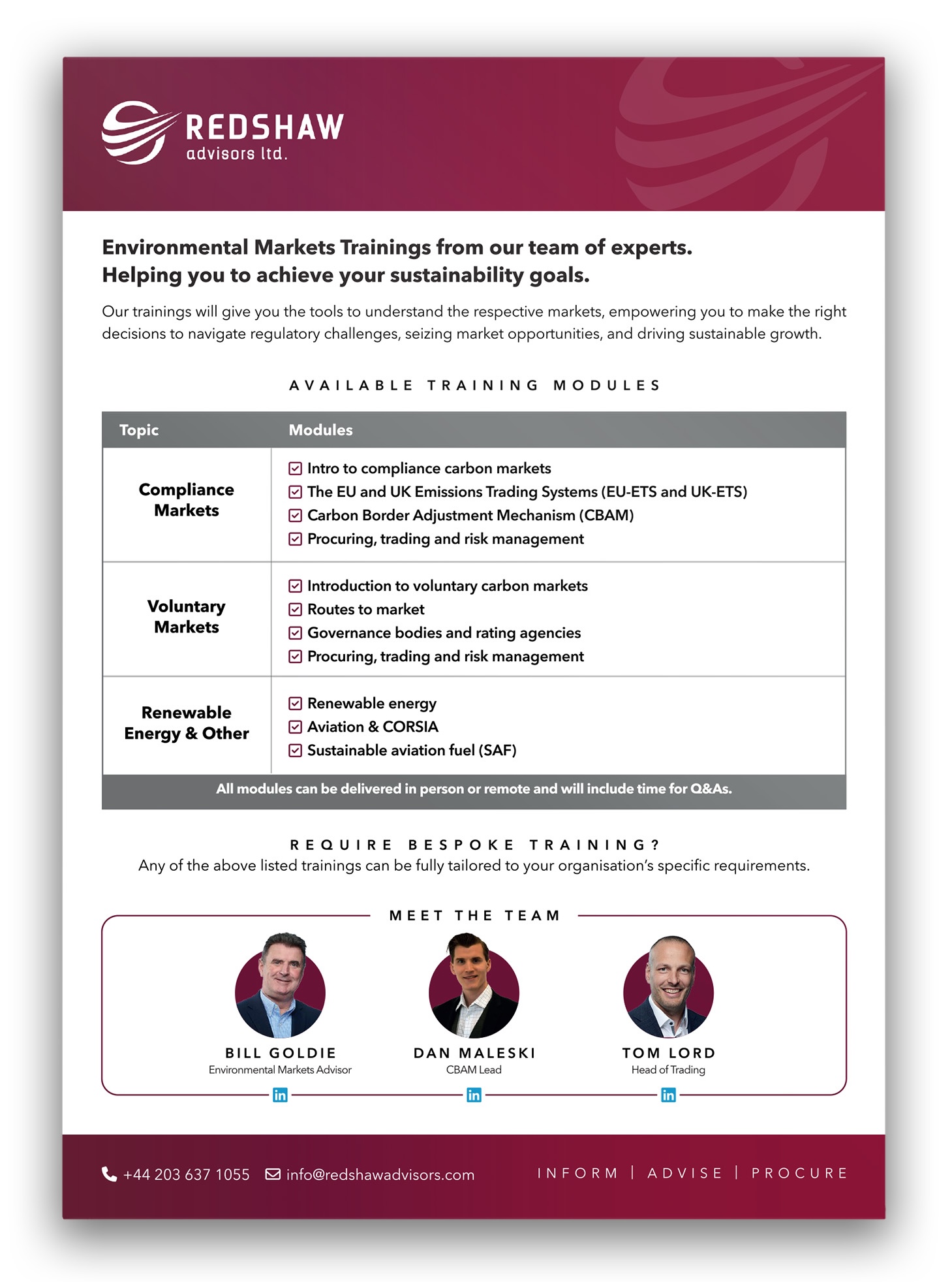

Environmental Markets Training

Our trainings will give you the tools to understand the respective markets, empowering you to make the right decisions to navigate regulatory challenges, seizing market opportunities, and driving sustainable growth.

Dan Maleski Featured In:

More About CBAM

Steel sector concerns remain post CBAM implementation

The steel sector’s concerns regarding the implementation of the transitional phase of the European Union’s Carbon Border Adjustment Mechanism (CBAM) remain…

Reporting Recommendations and Requirements for the EU CBAM

The CBAM’s reporting requirements, introduced through the Implementing Regulation, constitute one of the most extensive sets of greenhouse gas (GHG) emissions reporting requirements…

Measurement of embedded emissions and compliance with EU CBAM

The Implementing Regulation outlines the procedures for monitoring and calculating the embedded emissions of imported products. The specific rules for calculating these emissions…