Market developments:

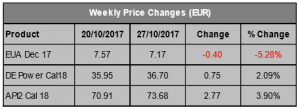

- Carbon falls more than 5% to end the week at €7.17

- Large gains in the 2019 and 2020 clean dark spreads not enough to support carbon

- Technical support at €7.30 broken

- UK government to request EU ETS transition period

- Redshaw Advisors are hiring. Check it out and share our link with anyone you think may be interested.

EU Allowance Auction Overview:

- Auction volume falls slightly this week (~21.5Mt vs ~22.1Mt)

- Another ~91.5Mt EUAs set to come to market in November before December auction volumes fall to ~52.4Mt

- See auction table below for details

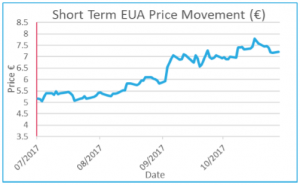

EUA PRICE ACTION

Carbon fell more than 5% last week despite the clean dark spreads making large gains. Price action was largely centred around two days, Monday and Thursday, when 13c and 21c were wiped off the price respectively. The falls came despite significant strengthening of the clean dark spreads, particularly in the 2019 and 2020 contracts, as recent policy impacts continue to be felt in power prices across Europe. The recent announcements by Italy, France and the Netherlands to introduce policies aimed at shutting coal fired power plants has driven power prices higher on supply fears leading to higher clean dark spread returns. However, the

Carbon fell more than 5% last week despite the clean dark spreads making large gains. Price action was largely centred around two days, Monday and Thursday, when 13c and 21c were wiped off the price respectively. The falls came despite significant strengthening of the clean dark spreads, particularly in the 2019 and 2020 contracts, as recent policy impacts continue to be felt in power prices across Europe. The recent announcements by Italy, France and the Netherlands to introduce policies aimed at shutting coal fired power plants has driven power prices higher on supply fears leading to higher clean dark spread returns. However, the  clean dark spread gains and the onset of colder weather were not enough to provide support for carbon which, in the absence of further bullish policy announcements, was unable to hold its ground. The close at €7.17 was only just above the week’s low at €7.13 and does not bode well coming into this week. Price Impact: last week we highlighted the multiple bullish factors that have surfaced recently and driven prices higher but warned that, at some point, the bullish developments would likely cease. Last week saw prices fall in the absence of further bullish developments and technical resistance at €7.30 was broken. Safe to say the floodgates did not open but we may be in store for some further softening in carbon prices….

clean dark spread gains and the onset of colder weather were not enough to provide support for carbon which, in the absence of further bullish policy announcements, was unable to hold its ground. The close at €7.17 was only just above the week’s low at €7.13 and does not bode well coming into this week. Price Impact: last week we highlighted the multiple bullish factors that have surfaced recently and driven prices higher but warned that, at some point, the bullish developments would likely cease. Last week saw prices fall in the absence of further bullish developments and technical resistance at €7.30 was broken. Safe to say the floodgates did not open but we may be in store for some further softening in carbon prices….

WEEK AHEAD

For the week ahead, we largely maintain last week’s view. In the absence of further bullish policy developments, carbon fundamentals may struggle to maintain the high prices witnessed recently. Auction volumes remain high through November (~91.5Mt) but there is some support for carbon on the horizon as volumes in December fall dramatically due to the

Christmas holiday. The weekend also saw the first cold snap of the 2017-18 winter and continued low temperatures will lend at least some support to carbon prices. But it seems much will depend on further Brexit developments. Based on available information we maintain our bearish outlook for the week ahead, in particular due to rumours that the UK plans to ask for an EU ETS transitional period (see ‘Other News’) that is separate from Brexit negotiations.

OTHER NEWS

UK government set to propose a 2-year EU ETS transitional period

The UK government is said to have asked for a 2-year transitional period in the EU ETS to avoid market disruption due to Brexit, according to reports by Platts. It is unclear when the transition period would begin but a date that would ensure UK participation to the end of Phase III would enable more time for discussion on the UK’s continued participation and provide a clean exit point, should the UK decide to leave the EU ETS.

The report went on to say, “….the Department for Business, Energy and Industrial Strategy was unable to confirm the UK's proposal for a two-year implementation period but confirmed that a range of options are on the table”. If a transitional period were to be agreed it is likely to have a bearish impact on EUA prices that rose in response to Amendment 47, the EUs solution to the risk of a UK sell-off in light of the UK’s ‘lapsing EU ETS obligations’.

Redshaw Advisors has produced a guide on the impacts of Amendment 47 here and we will have more information from the UK government later this afternoon following a discussion on EU ETS options postAmendment 47. We will inform you of any material developments, however, if you would like to discuss the exposure of your company to the EU ETS considering Brexit, please give the Redshaw Advisors team a call on +44 203 637 1055.

Coal phase out plans will reduce EUA demand by more than 68Mt

National policies implemented by the UK, France and Italy would reduce EU ETS demand by more than 68Mt with no plans for a corresponding reduction in auction supply. All 3 nations have announced plans to cease coal fired power generation leading to lower emissions across Europe. However, the impact on the EU ETS is negative as the emissions reductions are not driven by the EU ETS price, rather regulation or tax.

Conversely, the Netherlands has a similar plan to phase out coal fired power generation, but unlike the other 3 countries they plan to cancel a corresponding number of allowances, leading to no negative impact on the EU ETS.