Market developments:

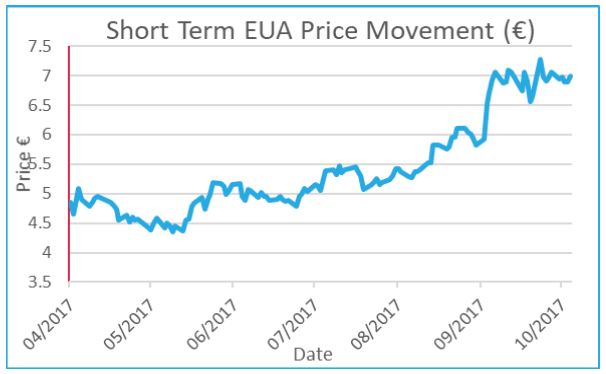

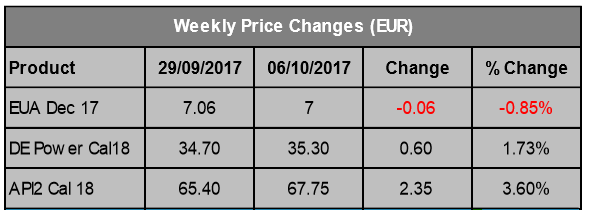

- Volatility subsides – weekly trading range of just 36c vs 98c avg over last 4 weeks

- Small 6c fall as week closes at €7.00

- Coal gains outstrip power to lead the clean dark spreads lower

- Phase IV reform inches towards agreement but is likely to remain elusive this week

- Redshaw Advisors are hiring. Please share the link with anyone that you think might be interested.

EU Allowance Auction Overview:

- Volume increases to ~22.1Mt this week, up from ~17.3Mt last week

- Auction supply will remain high in October as ~91.5Mt comes to market, slightly down on September’s ~91.8Mt

- See auction table below for details

EUA PRICE ACTION

Calm returned to the carbon market last week as the weekly trading range dropped to just €0.36, down from a €0.98 average over the last four weeks (€1.31, €1.20, €0.73 & €0.69). The volatility witnessed over the last 4 weeks was the result of several price drivers combined, however, in the absence of major developments last week the carbon market returned to ‘order’. The range of €7.13 to €6.77 with a more-or-less flat close gives us few clues as to future price direction. The low of the week came on Friday as EUAs appeared to be heading for a larger weekly loss but in the end clean dark spreads staged a recovery that lifted carbon back up to €7 to register a weekly loss of just €0.06. Price Impact: the previous 4-weeks have been a rollercoaster ride and carbon took a breather last week. The political machinations of Phase IV and Brexit are yet to be concluded so further volatility is likely before year end, but it might not be this week…

Calm returned to the carbon market last week as the weekly trading range dropped to just €0.36, down from a €0.98 average over the last four weeks (€1.31, €1.20, €0.73 & €0.69). The volatility witnessed over the last 4 weeks was the result of several price drivers combined, however, in the absence of major developments last week the carbon market returned to ‘order’. The range of €7.13 to €6.77 with a more-or-less flat close gives us few clues as to future price direction. The low of the week came on Friday as EUAs appeared to be heading for a larger weekly loss but in the end clean dark spreads staged a recovery that lifted carbon back up to €7 to register a weekly loss of just €0.06. Price Impact: the previous 4-weeks have been a rollercoaster ride and carbon took a breather last week. The political machinations of Phase IV and Brexit are yet to be concluded so further volatility is likely before year end, but it might not be this week…

WEEK AHEAD

The tight trading range witnessed last week may well continue as traders are wary of developments at the trilogue meeting and on the Brexit related EU ETS amendment. With prices failing to move last week and a return to higher auction volumes it would appear further softening in prices is more likely than gains but so far, the support around €6.80 has been resolute and material falls look unlikely. The low volatility suggests

The tight trading range witnessed last week may well continue as traders are wary of developments at the trilogue meeting and on the Brexit related EU ETS amendment. With prices failing to move last week and a return to higher auction volumes it would appear further softening in prices is more likely than gains but so far, the support around €6.80 has been resolute and material falls look unlikely. The low volatility suggests

OTHER NEWS

Phase IV reform inches towards agreement but it is unlikely to come this week

The Council, made up of ministers from Member States, has firmed up it’s negotiating position ahead of the Phase IV trilogue meeting on Thursday. Agreement on the final package has so far been elusive as Member States and the Parliament lock horns. A cancellation of allowances in 2023 is said to be agreed, however, the auction share flexibility mechanism and Innovation Fund are likely to continue to remain contentious. The Parliament wishes to put in place a 5% auction flexibility share in the event the Cross Sectoral Correction Factor is triggered in Phase IV, however, Member States have so far only been willing to table a 2% flexibility share. That view has apparently only softened slightly with Member States now willing to return to the negotiating table with an extra 0.5%. Whether this is enough for the EU Parliament remains to be seen.

The affect on free allocation in Phase IV is the most significant risk in the trilogue discussions to operators of EU ETS installations, as the MSR debate is seemingly settled. Both have the potential to significantly increase the cost of complying with the EU ETS.

To find out more about the MSR, tightening free allocations, lower benchmarks and a higher Linear Reduction Factor, get in touch and we’ll give you a Phase IV update.

Zero greenhouse gas emissions goal supported by EU Parliament

The EU Parliament has backed calls for a 2050 zero emissions strategy to be developed by 2018 by the European Commission. The strategy should aim to keep the EU in line with the Paris agreement for temperature rises below 2oC with the aim of limiting rises to 1.5oC. Additionally, MEPs called for further investigation into the EU risk of carbon leakage in light of US plans to withdraw from the Paris agreement. Carbon border taxes and consumption charges are measure that could be employed to ensure a level playing field with those who choose not to abide by the Paris agreement.

Redshaw Advisors are hiring

We are currently looking for both a Junior and Senior Business Developer to help expand our sales activity across both the existing and emerging Emissions Trading Systems. The roles are suited to highly motivated, ambitious and flexible individuals who enjoy navigating challenges and who are attracted to, or have experience of, working in a growth stage startup. Click here for more information.