Market developments:

- Carbon suffers early falls before stabilising

- Quiet trading week sees muted volumes and tightening daily trading ranges

- Strong support found at €7.73-€7.74

- Weather forecasts suggest above average temperatures in January

- Looking to purchase allowances for your compliance requirements? Sign up for our daily round-up through the compliance period

- Redshaw Advisors Group Training Day – let us know if you are interested. See more information on page 3.

EU Allowance Auction Overview:

- Auctions resume on Monday 8th January, 2018

- 16.99Mt comes to market this week in the first of the 2018 auctions

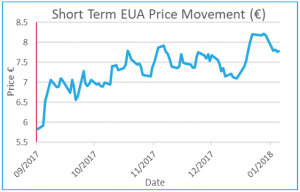

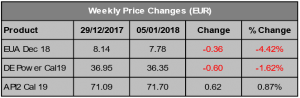

EUA PRICE ACTION

Some of the year-end froth came out of the carbon market last week as prices fell more than 4%. Prices had risen by more than a Euro in the auctionless period before Christmas on mixed fundamentals but the looming auction resumption added a bearish pressure into the mix last week. The main price move came on Tuesday as traders returned to their desks and exited or reversed speculative long positions that had contributed to the pre-Christmas highs. Prices gapped lower on the first open of 2018 and ended the day at €7.79, down near the bottom of the days 40c range. The remainder of the week saw muted trading volumes

Some of the year-end froth came out of the carbon market last week as prices fell more than 4%. Prices had risen by more than a Euro in the auctionless period before Christmas on mixed fundamentals but the looming auction resumption added a bearish pressure into the mix last week. The main price move came on Tuesday as traders returned to their desks and exited or reversed speculative long positions that had contributed to the pre-Christmas highs. Prices gapped lower on the first open of 2018 and ended the day at €7.79, down near the bottom of the days 40c range. The remainder of the week saw muted trading volumes  with no clear direction established. Strong support was found at €7.73-€7.74, a level that was tested every day of the week but held firm. To the upside, prices failed to break back above €8 as the daily trading range narrowed through the week, Friday saw just a 10c range. Elsewhere, the clean dark spreads fell as power prices declined with carbon whilst coal ended the week in positive territory. Price Impact: the muted trading volumes suggest the market was largely still in holiday mode. The resumption of auctions will likely bring the market back to life.

with no clear direction established. Strong support was found at €7.73-€7.74, a level that was tested every day of the week but held firm. To the upside, prices failed to break back above €8 as the daily trading range narrowed through the week, Friday saw just a 10c range. Elsewhere, the clean dark spreads fell as power prices declined with carbon whilst coal ended the week in positive territory. Price Impact: the muted trading volumes suggest the market was largely still in holiday mode. The resumption of auctions will likely bring the market back to life.

WEEK AHEAD

Despite the price falls last week, carbon is still some 35c or so higher than it was on the 18th December, 2017, the date of the last EUA auction of 2017. All eyes will be on the resumption of auctions this week which adds a bearish pressure into the mix, albeit with lower volumes than before Christmas as the UK fortnightly auctions are not set to resume until February. If utility and industrial hedging kicks back into gear there is no reason the auction resumption alone should cause material downward pressure, especially with slightly lower-than-expected volumes in January. However, the overall fundamental picture would suggest prices will struggle to advance back above €8 in the short term. January weather forecasts suggest much of Europe will see above average temperatures, nuclear availability is higher, renewable generation has been good, gas prices have eased from the highs whilst coal price continues to push higher and the once-a-year compliance buying is unlikely to have a big impact in the coming weeks. Our outlook is bearish in the short term.

OTHER NEWS

EU begins monitoring and verifying maritime emissions

New EU regulation requiring ships making use of Member State ports to monitor, report and verify (MRV) their emissions entered into force last week. Initially, ship owners will have no carbon surrendering requirements, however, the EU will take steps to include shipping emissions in the EU ETS should the International Maritime Organisation fail to make progress enforcing global emissions reduction measures by 2023. The MRV regulation will force vessels over 5,000 gross tonnes to report their CO2 emissions and annual fuel consumption to an accredited shipping emissions verifier. The regulation will ignore the origin of the vessel and apply to any vessel carrying cargo or passengers for commercial purposes on a journey that starts or finishes in an EU Member State.

UK government reveals plan for coal phase out

A new emissions intensity limit of 450g CO2/kWh will be applied to UK coal fired power plants from 1st October, 2025 as part of the UK government plan to phase out coal fired power generation. In conjunction with several other measures, the UK government expects much of the coal fired power generation in the UK to cease operations in the early 2020’s.

It is expected that some plants will convert from coal to gas fired power generation with both Drax and EPH, owners of Eggborough power station, having confirmed plans to do so. The closure of coal fired power plants is expected to reduce annual CO2 emissions by 15Mt with much of the existing coal fired capacity already closed or on reduced generation hours due to the Carbon Price Floor applied to UK power generators.