Market developments:

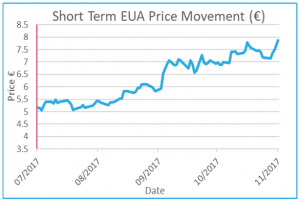

- Carbon adds more than 9% in another action-packed week

- Week closes at €7.87, a 70c rise

- Clean dark spreads fall by up to 20%

- UK government to seek early 2018 compliance deadline

- Energy Aspects increase price forecast

- Worried about EU ETS Brexit risk? Contact us to join our confidential EU ETS-installations-only working group

- Valued our support in 2017? Please spare 2 minutes to vote for Redshaw Advisors in the Environmental Finance rankings

EU Allowance Auction Overview:

- Auction volume increases to ~23.2Mt this week, up from ~21.5Mt

- ~90.4Mt EUAs set to come to market in November before December auction volumes fall to ~53.5Mt

- See auction table below for details

EUA PRICE ACTION

Another action-packed week for carbon as 70c was added to the price despite some bearish fundamentals. The price rise of more than 9% leaves the benchmark contract within touching distance of €8 just as winter weather is on the horizon. The week began with further softening in price as the bearish momentum established the previous week continued. However, lower prices were short lived as carbon quickly climbed away from Tuesday’s low (€7.09) with the contract finishing higher on each of the remaining days of the week. The moves higher came despite large falls in the Clean Dark Spreads (CDS) – ordinarily the two would move together. Curiously, despite the price increases and strong demand displayed

Another action-packed week for carbon as 70c was added to the price despite some bearish fundamentals. The price rise of more than 9% leaves the benchmark contract within touching distance of €8 just as winter weather is on the horizon. The week began with further softening in price as the bearish momentum established the previous week continued. However, lower prices were short lived as carbon quickly climbed away from Tuesday’s low (€7.09) with the contract finishing higher on each of the remaining days of the week. The moves higher came despite large falls in the Clean Dark Spreads (CDS) – ordinarily the two would move together. Curiously, despite the price increases and strong demand displayed  throughout the week, Friday’s German auction failed to clear due to lack of demand! The cancelled auction became a bullish price driver in the short-term as those that expected to pick up some volume in the auction were forced into the secondary market. Prices consequently climbed to the week’s high at €7.91 on Friday after the cancelled auction. Price Impact: we went into last week with a bearish outlook and despite fundamental moves supporting our outlook (normal cold weather aside), the market had other ideas. The divergence of price action from fundamental factors would suggest there is something unpredictable at play that is creating additional demand. One theory is additional largevolume speculative activity (that is not taking part in the auctions) in the run up to the trilogue meeting on Wednesday. Alternatively, a utility is accelerating its hedging programme (which ties in with falling CDS).

throughout the week, Friday’s German auction failed to clear due to lack of demand! The cancelled auction became a bullish price driver in the short-term as those that expected to pick up some volume in the auction were forced into the secondary market. Prices consequently climbed to the week’s high at €7.91 on Friday after the cancelled auction. Price Impact: we went into last week with a bearish outlook and despite fundamental moves supporting our outlook (normal cold weather aside), the market had other ideas. The divergence of price action from fundamental factors would suggest there is something unpredictable at play that is creating additional demand. One theory is additional largevolume speculative activity (that is not taking part in the auctions) in the run up to the trilogue meeting on Wednesday. Alternatively, a utility is accelerating its hedging programme (which ties in with falling CDS).

WEEK AHEAD

The market is well supplied this week as the failed German auction volume will now be spread evenly over the next four weeks, resulting in more than 23Mt coming to market. Overall, the market feels like it should be due a correction lower but the unexpected buying interest this week and the fact of the last few months price rises makes it difficult to predict when, or even if, that may come. The forces at play last week overcame the volumes on offer with ease and showed scant regard for other fundamental factors so further strength cannot be ruled out this week. Observable fundamentals will likely influence prices eventually, however the closer we get to the start of the MSR the less opportunity there will be for a material price drop. Watch out for the trilogue meeting on Wednesday, a positive result could end up leading to price falls as speculators engage in ‘buying the rumour, selling the fact’.

OTHER NEWS

BREXIT UPDATE: the UK government to seek early 2018 compliance deadline

In a conference call last week, the UK government outlined their response to the European Parliament’s ‘Brexit clause’ which, if enforced, will invalidate all UK issues allowances from 1st January, 2018. With previous counter-proposals having gained little or no traction in Brussels, the UK government are now set to put in motion a Statutory Instrument to bring forward the compliance deadline for UK installations only.

In a race against time, the UK government hopes to prove Amendment 47 is unnecessary and thereby avoid the invalidation of UK issued allowances which threatens to split the EUA market in two.

Redshaw Advisors have created a BREXIT IMPACTS discussion group that all EU ETS installations should join. We will provide regular Brexit updates as well as engage in Q&A discussion of the specific concerns of installations covered by the EU ETS. To encourage debate, participation in the discussion group will be anonymous.

Alternatively, Redshaw Advisors have produced a guide on the potential impacts of Amendment 47 here.

2017 Environmental Finance carbon market rankings – voting closes tomorrow (Tuesday 7th Nov)

Redshaw Advisors have been shortlisted to win several awards in the 2017 Environmental Finance carbon market rankings but we need your help. Over the course of 2017 we hope you have found our weekly update useful and concise, used our services to help lighten the burden of the EU ETS, learned something new at Carbon Forward 2017 or you have valued another interaction with us. If so, we would be grateful if you could spare 2 minutes to vote for us in the following categories;

EU Emissions Trading System

- Best trading company, spot & futures

- Best advisory/consultancy

KYOTO PROJECT CREDITS (JI and CDM)

- Best trading company, secondary market

- Best advisory/consultancy

Voting closes Tuesday 7th November, 2017. CAST YOUR VOTE HERE

Energy Aspects increase carbon price forecast in response to Brexit clause

Energy Aspects have increased their Q4 2017 and 2018 price forecasts by €0.50 and €1.0 respectively in response to the Brexit clause. The increase is based on the view that the clause will “have a bigger supplyside effect than a demand-side effect.” The increased price forecasts come amid a back drop of spiralling EUA prices as a number of bullish factors have combined. The increased outlook for 2018 will lead to compliance cost increases for installations across Europe ahead of the MSR which is set to more than double carbon prices into the end of Phase III.

To discuss your increasing long-term exposure to the EU ETS please give the Redshaw Advisors team a call on +44 203 637 1055.