Market developments:

- Further gains for carbon as power continues to move higher

- Week closes up 4.6% at €6.10

- Big gains for the clean dark spreads as strong Euro cancels out coal

- provides EU ETS lifeline to UK installations

- Utilities reign-in forward power hedging in search of higher returns

EU Allowance Auction Overview:

- Volume up slightly to ~11.2Mt from ~10.8Mt in the last week of curtailed supply

- September auction supply more than doubles to ~91.8Mt, up from ~44Mt in August

- See auction table below for details

Carbon Forward 2017 Programme has been released, venues announced

LIMITED AVAILABILITY: for installations producing less than 1 million tonnes of CO2 Redshaw Advisors have negotiated rates with up to 70% off! See advert below. Register your interest. This year’s conference will be held at the 5-star Canary Riverside Plaza Hotel in London’s Canary Wharf.

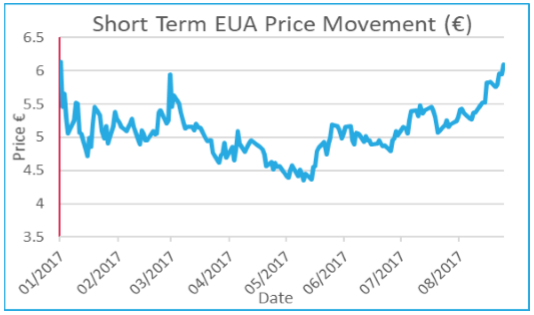

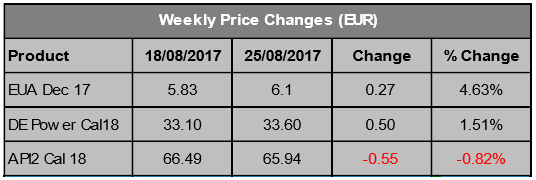

EUA PRICE ACTION

Carbon defied the upcoming increase in auction supply by adding a further 4.6% to the price, closing the week at €6.10. Friday’s close is the first time since January that carbon has managed to end the day above €6. The gains were once again fuelled by rising power markets as worries over nuclear supply continued causing power prices to hit multiyear highs. This, coupled with a further strengthening in the EUR/USD rate to an 18-month high, led the clean dark spreads materially higher as gains in USD denominated coal were cancelled out by EUR strength. The front 3 calendar year spreads added 10-20% over the course of the week, providing incentive for utilities to hedge their exposure and perhaps allow some to play ‘catch up’ on previously unhedged generation (see Other News for more information). Price Impact: the expected price dip did not materialise as power took control, the EUR strengthened and lower auction supply compounded the subsequent market tightness.

Carbon defied the upcoming increase in auction supply by adding a further 4.6% to the price, closing the week at €6.10. Friday’s close is the first time since January that carbon has managed to end the day above €6. The gains were once again fuelled by rising power markets as worries over nuclear supply continued causing power prices to hit multiyear highs. This, coupled with a further strengthening in the EUR/USD rate to an 18-month high, led the clean dark spreads materially higher as gains in USD denominated coal were cancelled out by EUR strength. The front 3 calendar year spreads added 10-20% over the course of the week, providing incentive for utilities to hedge their exposure and perhaps allow some to play ‘catch up’ on previously unhedged generation (see Other News for more information). Price Impact: the expected price dip did not materialise as power took control, the EUR strengthened and lower auction supply compounded the subsequent market tightness.

WEEK AHEAD

Carbon is a passenger to events in power markets at present which makes predicting the week ahead difficult. There are contrasting signals as auction volumes return to normal on Friday and September will see volumes more than double to ~91.8Mt from ~44Mt in August. Additionally, a prominent technical indicator is signalling carbon price is in ‘over-bought’ territory but speculators eyeing a short position will be cautious if they were, as suspected, previously burnt by short selling at €5.50. The utilities have been in the driving seat for a while now and further strengthening in the clean dark spreads could see the trend continue. The power generation mix will also be crucial. The first half of 2017 has seen an increase in thermal generation and therefore emissions as renewable and nuclear supply has come up short of expectations. Nuclear generation is scheduled to increase in Q4 2017, however the on-going nuclear safety issues leave that forecast looking shaky at best. With the market absorbing high auction volumes through the second half of June and July with ease it would appear the market is finely balanced with nonfossil generation issues tipping the market slightly short. Overall, we maintain our view that prices will likely correct lower as full-scale auctions resume but this comes with the caveat that further developments in the power markets will make things unpredictable.

Carbon is a passenger to events in power markets at present which makes predicting the week ahead difficult. There are contrasting signals as auction volumes return to normal on Friday and September will see volumes more than double to ~91.8Mt from ~44Mt in August. Additionally, a prominent technical indicator is signalling carbon price is in ‘over-bought’ territory but speculators eyeing a short position will be cautious if they were, as suspected, previously burnt by short selling at €5.50. The utilities have been in the driving seat for a while now and further strengthening in the clean dark spreads could see the trend continue. The power generation mix will also be crucial. The first half of 2017 has seen an increase in thermal generation and therefore emissions as renewable and nuclear supply has come up short of expectations. Nuclear generation is scheduled to increase in Q4 2017, however the on-going nuclear safety issues leave that forecast looking shaky at best. With the market absorbing high auction volumes through the second half of June and July with ease it would appear the market is finely balanced with nonfossil generation issues tipping the market slightly short. Overall, we maintain our view that prices will likely correct lower as full-scale auctions resume but this comes with the caveat that further developments in the power markets will make things unpredictable.

OTHER NEWS

Brexit paper provides EU ETS lifeline to UK installations

A Brexit paper produced by the UK government has suggested that the UK may not necessarily leave the EU ETS despite the end of the European Court of Justice (ECJ) jurisdiction over UK law, as part of the Brexit process. The removal of ECJ jurisdiction left question marks over continued participation as the UK faced the possibility of being part of a scheme but with no say in the formulation of the rules that govern it. However, the paper cites “precedents where the EU has reached agreements with third countries which provide for a close co-operative relationship without the ECJ having direct jurisdiction over those countries”.

Iceland, Norway and Liechtenstein already participate in the EU ETS but under the jurisdiction of European Free Trade Area (Efta) rather than the ECJ.

Utilities reign in forward power hedging in search of better returns

Second quarter hedging ratios reported by European utilities suggest less forward hedging has been done compared to historical levels as utilities eye higher returns. Low generation returns at the beginning of 2017 will have played a key role in the scale back as utilities choose to wait for improved returns, citing an expected tightness across Europe’s power markets for the reason for power price recovery long-term. The lower hedge ratios would help explain the weakness in the EU ETS price through the first half of the year. In addition, any ‘catch-up’ the utilities must do now generation spreads have moved materially higher will increase the demand for allowances through the remainder of 2017

Carbon Forward is back and Redshaw Advisors announced as official partner

The EU ETS is changing and those with most at risk, industry and aircraft operators, are in most need of understanding the impacts of the changes. The Carbon Forward 2017 conference will, with the help of a line-up of expert speakers, examine the issues affecting companies with exposure to the EU Emissions Trading System (ETS) and provide some answers. The conference will focus on:

- Brexit – the effect on EUA prices and UK emitters

- Carbon price rises – how the Market Stability Reserve changes everything

- Free allocation – how the Phase IV (2021-2030) review impacts your bottom line

- Advice – how to maximise free allocation and receive grants for new technology

EU ETS emitters are already expected to foot the bill for Europe’s flagship emissions reduction programme so to help reduce the financial burden Redshaw Advisors have negotiated special discounts for you. We are able to offer all companies emitting less than 1,000,000 tonnes of CO2 per year up to a 70% discount to the normal conference ticket prices as follows;

Training day (26th September) Normal price: £349, EU ETS emitters price: £249 + VAT (-38%)

Day 1: EU ETS (27th September) Normal price: £549, EU ETS emitters price: £189 + VAT (-66%)

Day 2: Global Markets (28th September) Normal price: £549, EU ETS emitters price: £189 + VAT (-66%)

Training + Day 1: EU ETS. Normal price: £799, EU ETS emitters price: £399 + VAT (-58%*)

Training + Day 2: Global Markets. Normal price: £799, EU ETS emitters price: £399 + VAT (-58%*)

Day 1: EU ETS + Day 2 Global Markets. Normal price: £899, EU ETS emitters price: £329 +VAT (-70%*)

Training + Day 1 + Day 2. Normal price: £1,099, EU ETS emitters price: £549 + VAT (-63%*)

*% reduction calculated by comparing to the cost of buying individual days

There is strictly limited availability of these discounted tickets so book your place now to avoid disappointment.

You can ask us to reserve you a ticket of your choice and the Carbon Forward team will send you an invoice or you can click on the links above to be taken straight to a WorldPay site to buy the tickets with a debit or credit card (note ticket prices will have VAT added to them that can be reclaimed). More details of the conference can be found at the Carbon Forward 2017 website.