Market developments:

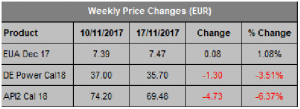

- Carbon advances to €7.47, up 1%

- Clean dark spreads continue higher

- High and low of the week trade within one day of each other

- UK threatens to scupper Phase IV reform vote in Brexit clause protest

- Final Phase IV compromise text gives further insight on shape of Phase IV

- Worried about EU ETS Brexit risk? Contact us to join our confidential EU ETS installations-only working group

EU Allowance Auction Overview:

- Auction volume increases to ~23.2Mt this week, up from 18.4Mt last week

- ~90.4Mt EUAs set to come to market in November before December auction volumes fall to ~53.5Mt

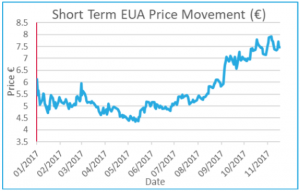

EUA PRICE ACTION

An indecisive week for carbon as prices spent time in both positive and negative territory. Prices eventually ended the week little changed and just 8c higher (we were bearish). The early moves extended the previous week’s falls, trading to the low of €7.24. However, a combination of improving clean dark spreads and some strong auctions helped carbon recover. Having rejected the lows, carbon quickly reached €7.50 and once resistance there was broken, prices raced to the high of the week on Wednesday, €7.80, as speculators closed out or reversed positions. The lack of auction that day seemed to trigger the moves higher. The low and

An indecisive week for carbon as prices spent time in both positive and negative territory. Prices eventually ended the week little changed and just 8c higher (we were bearish). The early moves extended the previous week’s falls, trading to the low of €7.24. However, a combination of improving clean dark spreads and some strong auctions helped carbon recover. Having rejected the lows, carbon quickly reached €7.50 and once resistance there was broken, prices raced to the high of the week on Wednesday, €7.80, as speculators closed out or reversed positions. The lack of auction that day seemed to trigger the moves higher. The low and  high traded within a day of each other, showing the speed of the reversal and indecision amongst traders on the future direction of the market. €8 appeared to be the target, however, strong resistance and wider energy market price falls meant carbon failed to advance any further and dropped back to end the week at €7.47. Elsewhere, large falls in the coal price led to substantial clean dark spread gains as power prices stayed relatively strong and the Euro strengthened against the USD. Price Impact: The large CDS gains are bullish so the failure of carbon to hold onto higher prices during a low auction week suggests that underlying demand from the utilities was not that strong and they are now quite well hedged.

high traded within a day of each other, showing the speed of the reversal and indecision amongst traders on the future direction of the market. €8 appeared to be the target, however, strong resistance and wider energy market price falls meant carbon failed to advance any further and dropped back to end the week at €7.47. Elsewhere, large falls in the coal price led to substantial clean dark spread gains as power prices stayed relatively strong and the Euro strengthened against the USD. Price Impact: The large CDS gains are bullish so the failure of carbon to hold onto higher prices during a low auction week suggests that underlying demand from the utilities was not that strong and they are now quite well hedged.

WEEK AHEAD

The lack of direction for carbon last week provides few clues on price moves this week. There are a number of bearish influences this week: auction volumes climb to over 23Mt and milder weather is forecast. Reports over the weekend suggest the UK might vote against the Phase IV reforms if the Brexit clause is implemented. While an unlikely outcome it does create further volatility risk, but with a downside skew. The failure of Angela Merkel to form a coalition government in Germany, due to differences over, amongst other things, green policies, casts more doubt over the European economy. However, carbon has shown resilience of late and has held on to most of the gains made over the last 6 months. Generation spreads are strong and should provide a fairly solid base for carbon. But overall, the market feels like it is reaching a crunch point, either carbon must advance through €8, or, prices may shift lower. The size of any falls will likely be limited by nuclear availability and winter. If the price can’t get through €7.00 or so this week, with several bearish headwinds, then price is more likely to re-test €8.00 as we approach December’s auction hiatus.

OTHER NEWS

BREXIT UPDATE: UK government may vote against Phase IV reforms in Brexit backlash

Reports emerged over the weekend suggesting the UK government may vote against the Phase IV reforms in a Brexit clause backlash. The two-year process to agree Phase IV reforms is nearing its end, however, Member State approval is still required, and the UK may seek to join up with Eastern European states who are unhappy with the reform package. The UK has long been a supporter of ambitious reform and has been a key player in the negotiations. However, the recent Brexit clause that will invalidate UK issued allowances from 1st January, 2018 has led to the possibility that the UK votes against the reforms unless it receives assurances on the withdrawal of the clause. The UK has already set out an alternative proposal that would shift the compliance dates for UK installations only, but it is currently unclear whether this will get Member State approval.

Should the UK vote against the Phase IV reforms and successfully block their passage, there will be a material downwards correction for EUAs. Watch this space.

Redshaw Advisors have created a BREXIT IMPACTS discussion group that all EU ETS installations should join. We will provide regular Brexit updates as well as engage in Q&A discussion of the specific concerns of installations covered by the EU ETS. To encourage debate, participation in the discussion group will be anonymous and is reserved for EU ETS installations only. Join the group here.

Redshaw Advisors have produced a brief guide to the potential impacts of Amendment 47 here.

German coalition talks breakdown as parties failed to find common energy and migration ground.

German coalition negotiations have broken down as the parties involved have failed to find common ground on energy and migration issues. The breakdown in talks leave German Chancellor, Angela Merkel, facing the possibility of forming a minority government or calling fresh elections. The Green Party, one of the proposed coalition partners, have pushed for a coal fired power closure of 8-10GW, however, the remaining coalition partners were concerned about the effect on jobs in the energy and manufacturing industries. As the most powerful nation in the EU ETS, the strength and ambition of the German government is key to its developments.

Final Phase IV compromise text gives further insight on the shape of Phase IV rules

The final compromise text on the Phase IV reforms provides further insight into the rules that will guide free allocation in Phase IV. We have picked out some of the more significant points for installations;

- Free allocation will drop to zero by 2030 for those not deemed to be exposed to carbon leakage

- Opt-out threshold kept at 25,000t • Production increases or decreases of 15% will lead to free allocation amendments

- No more than 25% of auction revenues may be directed to indirect cost compensation

Please get in touch with the Redshaw Advisors team on +44 203 637 1055 for a more detailed analysis of the impact on your company.

COP23 moves the Paris Accords slowly forwards but little of note for EU ETS participants

The latest Conference of the Parties (COP) taking place in Bonn, Germany has advanced some technical points, including a review of progress towards achieving each countries Nationally Determined Contributions (NDCs) but has so far yielded little of relevance to EU ETS participants. COPs tend to look at national level issues such as the use of markets and targets as well as adaptation issues. The EU ETS plays an important role in NDCs of European countries, however, the rules and regulations of the EU ETS were not discussed in Bonn.