Market developments:

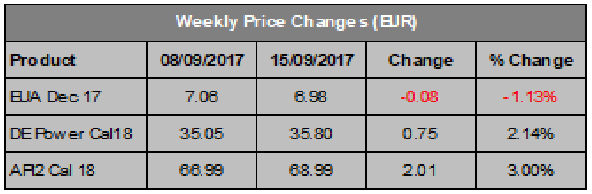

- Carbon ends the week down having hit a new 2017 high at €7.72

- Week closes at €6.98, a 1% fall

- Power prices in the driving seat as on-going supply concerns lead prices higher

- Trilogue talks fail to find Phase IV final agreement

- EU Parliament agrees to Brexit ‘safeguard’

EU Allowance Auction Overview:

- Volume falls to ~22.6Mt, down from ~25.3Mt last week

- September auction supply more than doubles to ~91.8Mt, up from ~44Mt in August

- See auction table below for details

BREXIT, Phase IV, Analyst showdown, Paris Agreement, Internal Carbon Pricing …and much more. LAST CHANCE TO RESERVE YOUR PLACE AT DISCOUNTED RATES: As you can read in this week’s carbon market update there’s a lot going on in carbon markets. Get up to speed by taking advantage of the up to 70% discount Redshaw Advisors have negotiated for places at September’s Carbon Forward 2017 conference. See the advert below to buy tickets or download the programme here.

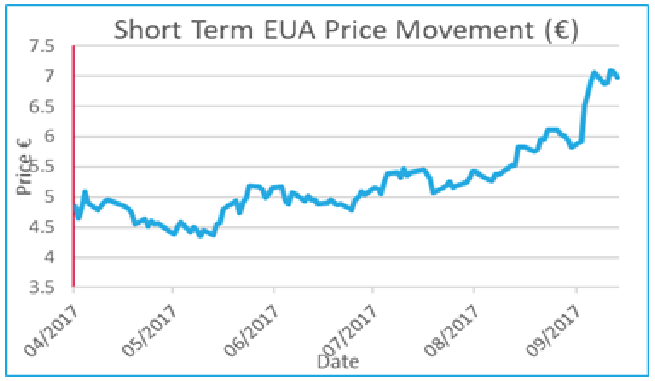

EUA PRICE ACTION

Carbon fell 8c last week to end the week at €6.98 having hit a new 2017 high at €7.72 intra-week. We were cautiously bearish last week but we certainly didn’t expect a trading range of €1.20 and quite such an action-packed week. The underlying cause of price increases since May, strong power prices, has remained the same over the last few months but the related markets went into overdrive last week as strong power prices, influenced by climbing coal and gas prices, took carbon hostage resulting in large price gains. Last week’s power price rise led the clean dark spread to new year-to-date highs and brought the utilities to market in force. With the highest ever weekly auction supply coming to market last week there was pressure on prices however the excitement in other markets coupled with some upward momentum created by the positive Trilogue meeting and of course the bullish influence of the Brexit ‘safeguards’ woke the carbon markets up. Moves higher were exacerbated by speculators jumping on the band wagon but Thursday’s roller-coaster ride to €7.72 was immediately snuffed out and common sense prevailed in such a large auction week. Thursday ended up at €7.06, 4c down on the previous day and Friday at €6.98. Price Impact: with carbon fundamentals not supporting price rises it is increasingly clear that power markets are in the driving seat. This makes predicting carbon price moves hard at the moment, particularly as power prices are seemingly being

Carbon fell 8c last week to end the week at €6.98 having hit a new 2017 high at €7.72 intra-week. We were cautiously bearish last week but we certainly didn’t expect a trading range of €1.20 and quite such an action-packed week. The underlying cause of price increases since May, strong power prices, has remained the same over the last few months but the related markets went into overdrive last week as strong power prices, influenced by climbing coal and gas prices, took carbon hostage resulting in large price gains. Last week’s power price rise led the clean dark spread to new year-to-date highs and brought the utilities to market in force. With the highest ever weekly auction supply coming to market last week there was pressure on prices however the excitement in other markets coupled with some upward momentum created by the positive Trilogue meeting and of course the bullish influence of the Brexit ‘safeguards’ woke the carbon markets up. Moves higher were exacerbated by speculators jumping on the band wagon but Thursday’s roller-coaster ride to €7.72 was immediately snuffed out and common sense prevailed in such a large auction week. Thursday ended up at €7.06, 4c down on the previous day and Friday at €6.98. Price Impact: with carbon fundamentals not supporting price rises it is increasingly clear that power markets are in the driving seat. This makes predicting carbon price moves hard at the moment, particularly as power prices are seemingly being

driven by rumours of French nuclear outages rather than actual outages.

WEEK AHEAD

Auction volumes fall back to ~22.6Mt this week with the bulk of the cancelled auction volumes sold last week. With record auction volumes failing to dampen moves higher last week and uncertainty over power generation capacity continuing, it remains impossible to conclude that power and carbon prices will stop moving higher over the coming weeks/months. However, carbon fundamentals would suggest the market is over-supplied and would ordinarily correct lower. It is likely the market remains choppy as traders shift their focus to short term position taking. We remain cautiously bearish.

Auction volumes fall back to ~22.6Mt this week with the bulk of the cancelled auction volumes sold last week. With record auction volumes failing to dampen moves higher last week and uncertainty over power generation capacity continuing, it remains impossible to conclude that power and carbon prices will stop moving higher over the coming weeks/months. However, carbon fundamentals would suggest the market is over-supplied and would ordinarily correct lower. It is likely the market remains choppy as traders shift their focus to short term position taking. We remain cautiously bearish.

OTHER NEWS

Trilogue talks fail to find Phase IV final agreement

The latest round of trilogue negotiations has failed to find overall agreement on the Phase IV reform package, however, progress was made with several compromises being found.

The most important agreement was on unilateral member state allowance cancellations and the doubling of the MSR withdrawal rate to last for five years, rather than four. However, other issues remain, such as the auction share of allowances in the event there are not enough to meet the demands of industry. The EU parliament wants a 5% flexibility clause, however the Member States at present are only willing to allow 2%.

The talks will resume on 12th October.

Some commentators saw the trilogue discussion as bullish however the only substantive aspect of the Phase IV reforms from a price development point of view is the doubling of the MSR withdrawal rate. This has been widely expected to be adopted since March/April so in our view there was no meaningful bullish news from the discussions.

EU parliament agrees to Brexit ‘safeguard’

The EU parliament adopted a measure to ‘safeguard’ the EU ETS last week in the event of UK installations leaving the EU ETS. The plan will see all allowances issued by a member state no longer in the scheme become invalid, placing question marks over any UK originated allowances from 1st January 2018. Despite the protests of IETA (International Emissions Trading Association) and EFET (European Federation of Energy Traders) amongst many others, the proposal was adopted and will likely divide the EUA market as installations seek to avoid being left with permits they cannot use. Details are still thin on the ground but there will be some important decisions that both UK and EU27 installations will have to make to safeguard the value of what they are allocated for free and what they buy. It is essential that installations develop a full understanding of all the risks this development creates. Advice will depend on each company’s circumstances. To discuss the best strategy for Brexit, the MSR and other market issues please feel free to get in touch with Redshaw Advisors on +44 203 637 1055.

Carbon Forward is back with Redshaw Advisors announced as official partner

The EU ETS is changing and those with most at risk, industry and aircraft operators, are in most need of understanding the impacts of the changes. The Carbon Forward 2017 conference will, with the help of a line-up of expert speakers, examine the issues affecting companies with exposure to the EU Emissions Trading System (ETS) and provide some answers. The conference will focus on:

- Brexit – the effect on EUA prices and UK emitters

- Carbon price rises – how the Market Stability Reserve changes everything

- Free allocation – how the Phase IV (2021-2030) review impacts your bottom line

- Advice – how to maximise free allocation and receive grants for new technology.

EU ETS emitters are already expected to foot the bill for Europe’s flagship emissions reduction programme so to help reduce the financial burden Redshaw Advisors have negotiated special discounts for you. We are able to offer all companies emitting less than 1,000,000 tonnes of CO2 per year up to a 70% discount to the normal conference ticket prices as follows;

Training day (26th September) Normal price: £349, EU ETS emitters price: £249 + VAT (-38%)

Day 1: EU ETS (27th September) Normal price: £549, EU ETS emitters price: £189 + VAT (-66%)

Day 2: Global Markets (28th September) Normal price: £549, EU ETS emitters price: £189 + VAT (-66%)

Training + Day 1: EU ETS. Normal price: £799, EU ETS emitters price: £399 + VAT (-58%*)

Training + Day 2: Global Markets. Normal price: £799, EU ETS emitters price: £399 + VAT (-58%*)

Day 1: EU ETS + Day 2 Global Markets. Normal price: £899, EU ETS emitters price: £329 +VAT (-70%*)

Training + Day 1 + Day 2. Normal price: £1,099, EU ETS emitters price: £549 + VAT (-63%*)

*% reduction calculated by comparing to the cost of buying individual days

There is strictly limited availability of these discounted tickets so book your place now to avoid disappointment.

You can ask us to reserve you a ticket of your choice and the Carbon Forward team will send you an invoice or you can click on the links above to be taken straight to a WorldPay site to buy the tickets with a debit or credit card (note ticket prices will have VAT added to them that can be reclaimed). More details of the conference can be found at the Carbon Forward 2017 website.