Market developments:

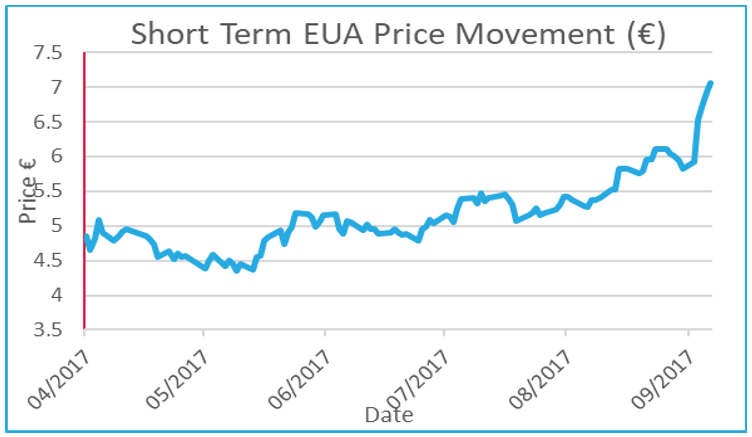

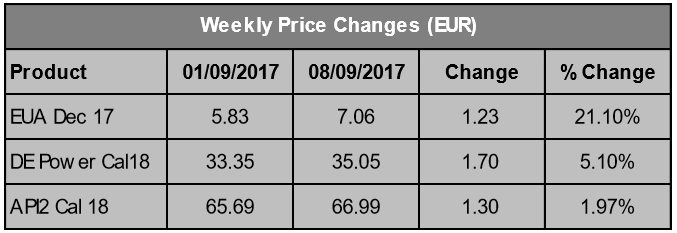

- Huge gains as the week closes at €7.06, 21% up

- Thursdays auction cancelled as reserve price not met with knock-on effect on auction calendar

- Clean dark spreads move higher as strong Euro limits coal gains

- EU Parliament proposes Brexit protection amendment that will paralyse the market

- EU Council of Ministers edges close to EU Parliament on Phase IV

EU Allowance Auction Overview:

- Volume higher as ~25.3Mt comes to market vs ~21.5Mt last week

- September auction supply more than doubles to ~91.8Mt, up from ~44Mt in August

BREXIT, Phase IV, Analyst showdown, Paris Agreement, Internal Carbon Pricing

…and much more. LAST CHANCE TO RESERVE YOUR PLACE AT DISCOUNTED RATES: Redshaw Advisors have negotiated up to 70% off tickets to attend September’s Carbon Forward 2017, this year’s principle carbon market conference. See the advert below to buy tickets or download the programme here. This year’s conference will be held at the 5-star Canary Riverside Plaza Hotel in London’s Canary Wharf.

EUA PRICE ACTION

Carbon rose more than 21% last week in an action packed 5 days that had it all – huge price rises, dips, strong auctions, weak auctions and even a cancelled auction. The week closed at €7.06, a €1.23 week-on-week gain as a number of bullish factors coincided. Over the past few months we have highlighted the bullish fundamentals that have taken carbon prices steadily higher from a low of €4.29 in May to €6.20 in August as auction curtailments left the market short. The return of full 11th auction volumes at the beginning of September would ordinarily have put downward pressure on prices however the coincidence of bullish factors was enough to send the market soaring last week. Utility (and some industrial) hedging, speculative longs, climbing power prices, a strong EUR against the USD, low renewable power (hydro) generation, positive signs coming from talks behind closed doors on an agreement on Phase IV reforms at the upcoming trilogue meeting, talk of a Franco-German alliance to boost carbon prices and a German election set to give us more Merkel have coincided to influence the market last week. Even the cancelled auction – a demonstration of low demand – turned into a bullish influence as it left the market millions of tonnes shorter than expected last week. The cancelled auction volume will now be added to the next four auctions. Away from carbon the clean dark spreads also moved higher last week as a further strengthening in the EUR/USD rate dampened higher USD denominated coal prices. Price Impact: we did not expect prices to move so much higher last week, however, we highlighted the fact the bullish influences that have supported the market for the last few months are still evident and therefore material price falls were unlikely and further gains remained a possibility.

Carbon rose more than 21% last week in an action packed 5 days that had it all – huge price rises, dips, strong auctions, weak auctions and even a cancelled auction. The week closed at €7.06, a €1.23 week-on-week gain as a number of bullish factors coincided. Over the past few months we have highlighted the bullish fundamentals that have taken carbon prices steadily higher from a low of €4.29 in May to €6.20 in August as auction curtailments left the market short. The return of full 11th auction volumes at the beginning of September would ordinarily have put downward pressure on prices however the coincidence of bullish factors was enough to send the market soaring last week. Utility (and some industrial) hedging, speculative longs, climbing power prices, a strong EUR against the USD, low renewable power (hydro) generation, positive signs coming from talks behind closed doors on an agreement on Phase IV reforms at the upcoming trilogue meeting, talk of a Franco-German alliance to boost carbon prices and a German election set to give us more Merkel have coincided to influence the market last week. Even the cancelled auction – a demonstration of low demand – turned into a bullish influence as it left the market millions of tonnes shorter than expected last week. The cancelled auction volume will now be added to the next four auctions. Away from carbon the clean dark spreads also moved higher last week as a further strengthening in the EUR/USD rate dampened higher USD denominated coal prices. Price Impact: we did not expect prices to move so much higher last week, however, we highlighted the fact the bullish influences that have supported the market for the last few months are still evident and therefore material price falls were unlikely and further gains remained a possibility.

WEEK AHEAD

Auction volumes this week will be higher than originally expected as the bulk of the cancelled auction volume comes to market. The result is five auctions, three of which are over 5Mt each in a total of more than 25Mt. However, as we saw last week, higher auction volumes are no guarantee of softer prices. If the underlying fundamentals remain strong it is impossible to rule out prices at least holding their ground if not pushing further up. We believe that some speculators were caught short last week and got themselves long, the cancelled auction fuelled that speculative activity. On balance the market is tipped towards the long side this week thanks to the extra 4Mt on offer in the auctions. Therefore, we expect some of the ‘froth’ to come out the market this week and we are cautiously bearish with a watchful eye on the underlying fundamentals and utility hedging rates.

Auction volumes this week will be higher than originally expected as the bulk of the cancelled auction volume comes to market. The result is five auctions, three of which are over 5Mt each in a total of more than 25Mt. However, as we saw last week, higher auction volumes are no guarantee of softer prices. If the underlying fundamentals remain strong it is impossible to rule out prices at least holding their ground if not pushing further up. We believe that some speculators were caught short last week and got themselves long, the cancelled auction fuelled that speculative activity. On balance the market is tipped towards the long side this week thanks to the extra 4Mt on offer in the auctions. Therefore, we expect some of the ‘froth’ to come out the market this week and we are cautiously bearish with a watchful eye on the underlying fundamentals and utility hedging rates.

OTHER NEWS

EU Parliament proposes regulation to minimise Brexit impact that risks the entire EU ETS traded market

The Financial Times reports this morning that the European Parliament will propose an amendment to the legislation governing the EU-ETS on Wednesday that would invalidate EUAs issued by a country that is exiting the EU-ETS (i.e. the UK). The proposed amendment would apply only to EUAs issued from 2018 onwards, to try to safeguard against the risk of mass EUA selling by UK participants in the EU-ETS before the end of the current trading period (which runs until 2020). The amendment would apply to all EUAs given out for free to UK installations from 2018 and UK EUA auctions from January 2018 onwards, if the UK were to leave the EU-ETS. The FT quoted MEP Peter Liese saying: “People still hope that Britain stays in the EUETS after Brexit”, adding that if the UK does leave the EU-ETS when it leaves the EU “we need to take care that there is no undue advantage to the UK, and no undue disadvantage to the rest of Europe.” The FT also quoted EU Parliament officials as saying that the initiative had been co-ordinated with the EU’s chief negotiator in the Brexit talks, Michel Barnier.

Redshaw Advisors comment: the plan is unworkable because it can be by-passed by savvy operators and it exposes the Europe-wide EU ETS to a material risk of a complete trading shutdown. In the case that UK 2018 free allocation is invalidated, operators in the UK can simply use 2018’s free allocation to comply with their 2017 emissions requirements and hold onto 2017 EUAs for sale at their leisure at a time in the future. The market on the other hand will grind to a halt under the legislation because no-one will want to risk paying for, and taking delivery of, an EUA that has no validity in the EU ETS. Not only can bilateral carbon traders not check where the EUAs being delivered have come from but neither can the exchanges. An alternative solution is as follows:

- Move MRV and compliance deadline for 2019 to 29th March (Brexit deadline).

- Invalidate 2019 auctioned UK EUAs or simply agree to suspend UK auctions in 2019 (unless postBrexit EU ETS agreement in place).

- Delay UK (or more easily all countries’) 2019 free allocation until 1st April 2019.

EU member states change position ahead of EU ETS talks

Ahead of a new round of trialogue negotiations talks taking place on 13th September between the EU member states, the EU Commission and Parliament, the Council of Ministers has agreed to move closer to the European Parliament’s position on a number of issues as follows: the council is now willing to cancel allowances from the MSR starting from 2021 rather than 2024, the emissions intensity levels that will determine exposure to carbon leakage from industrials, the voluntary cancellation of allowances by member states and the number of allowances that will go into the industrial support funds. The upshot of all of this is that agreement is more likely which will mean the MSR will double its withdrawal rate and the risk of overlapping policies impacting the price signal sent by the EU ETS is expected to decrease.

It is unlikely agreement will be reached during the talks this week after France and Germany said they are only targeting a final agreement ahead of the Nov. 6-17th UN climate talks, that will take place in Bonn. Further trialogue negotiation will continue in October 12th.

Carbon Forward is back and Redshaw Advisors announced as official partner

The EU ETS is changing and those with most at risk, industry and aircraft operators, are in most need of understanding the impacts of the changes. The Carbon Forward 2017 conference will, with the help of a line-up of expert speakers, examine the issues affecting companies with exposure to the EU Emissions Trading System (ETS) and provide some answers. The conference will focus on:

- Brexit – the effect on EUA prices and UK emitters

- Carbon price rises – how the Market Stability Reserve changes everything

- Free allocation – how the Phase IV (2021-2030) review impacts your bottom line

- Advice – how to maximise free allocation and receive grants for new technology

EU ETS emitters are already expected to foot the bill for Europe’s flagship emissions reduction programme so to help reduce the financial burden Redshaw Advisors have negotiated special discounts for you. We are able to offer all companies emitting less than 1,000,000 tonnes of CO2 per year up to a 70% discount to the normal conference ticket prices as follows;

Training day (26th September) Normal price: £349, EU ETS emitters price: £249 + VAT (-38%)

Day 1: EU ETS (27th September) Normal price: £549, EU ETS emitters price: £189 + VAT (-66%)

Day 2: Global Markets (28th September) Normal price: £549, EU ETS emitters price: £189 + VAT (-66%)

Training + Day 1: EU ETS. Normal price: £799, EU ETS emitters price: £399 + VAT (-58%*)

Training + Day 2: Global Markets. Normal price: £799, EU ETS emitters price: £399 + VAT (-58%*)

Day 1: EU ETS + Day 2 Global Markets. Normal price: £899, EU ETS emitters price: £329 +VAT (-70%*)

Training + Day 1 + Day 2. Normal price: £1,099, EU ETS emitters price: £549 + VAT (-63%*)

*% reduction calculated by comparing to the cost of buying individual days

There is strictly limited availability of these discounted tickets so book your place now to avoid disappointment.

You can ask us to reserve you a ticket of your choice and the Carbon Forward team will send you an invoice or you can click on the links above to be taken straight to a WorldPay site to buy the tickets with a debit or credit card (note ticket prices will have VAT added to them that can be reclaimed). More details of the conference can be found at the Carbon Forward 2017 website.