Market developments:

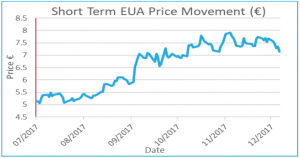

- Carbon falls nearly 7% to end the week at €7.15

- Near one-way traffic with losses in four of the five days

- Clean dark spreads fall as coal prices rise

- UK government begins process to bring forward 2018 compliance dates

EU Allowance Auction Overview:

- Auction volume down to ~21.5Mt this week, from 22.1Mt last week in the last full week of auctions in 2017

- December auction volumes fall to ~53.5Mt

- See auction timetable below

EUA PRICE ACTION

Carbon prices tumbled nearly 7% last week as the clean dark spreads fell and a series of unspectacular auctions failed to give the market any impetus. The close at €7.15 represents a 53c fall week-on-week. It was virtually one-way traffic as prices fell from the off and four of the five days registering a loss, only Thursday could muster gain, of just 7c. The largest fall came on Friday as 20c was wiped off the price following a weak auction. It is not clear what factor was in the driving seat last week, we had a neutral outlook and didn’t expect the falls. Possibly some of the decline

Carbon prices tumbled nearly 7% last week as the clean dark spreads fell and a series of unspectacular auctions failed to give the market any impetus. The close at €7.15 represents a 53c fall week-on-week. It was virtually one-way traffic as prices fell from the off and four of the five days registering a loss, only Thursday could muster gain, of just 7c. The largest fall came on Friday as 20c was wiped off the price following a weak auction. It is not clear what factor was in the driving seat last week, we had a neutral outlook and didn’t expect the falls. Possibly some of the decline  can be attributed to the upcoming December 17 EUA contract expiry as investors are forced to either close out positions or roll them to future dated contracts. The latter will have no price impact, but the former, assuming the bulk of the investor interest is positioned long, may have exerted some bearish pressure on EUA prices. This theory is backed by the Open Interest (the total of the open positions on any given contract) in the December 17 contract fell by more than the December 2018 contract increased, suggesting there was certainly an element of position close-out last week. Elsewhere, the clean dark spreads suffered as coal prices rose by 2.72% compared to power’s rise of 0.27%. Coal gains were exacerbated by a weaker EUR vs. the USD to reduce incentive for utilities to hedge. Price Impact: we had gone into the week with a neutral stance as colder weather and the looming auction shutdown looked set to underpin the market. That support did not materialise; however, it is too early to call a change in direction for carbon….

can be attributed to the upcoming December 17 EUA contract expiry as investors are forced to either close out positions or roll them to future dated contracts. The latter will have no price impact, but the former, assuming the bulk of the investor interest is positioned long, may have exerted some bearish pressure on EUA prices. This theory is backed by the Open Interest (the total of the open positions on any given contract) in the December 17 contract fell by more than the December 2018 contract increased, suggesting there was certainly an element of position close-out last week. Elsewhere, the clean dark spreads suffered as coal prices rose by 2.72% compared to power’s rise of 0.27%. Coal gains were exacerbated by a weaker EUR vs. the USD to reduce incentive for utilities to hedge. Price Impact: we had gone into the week with a neutral stance as colder weather and the looming auction shutdown looked set to underpin the market. That support did not materialise; however, it is too early to call a change in direction for carbon….

WEEK AHEAD

Carbon has not traded below €7 since 10th October, 2017. In that time, it has traded between €7 and €8 and these levels will be key in the coming week. Carbon is likely to run into strong support around €7.08 (the low of the recent range). The December options expiry on Wednesday throws another factor into the mix as traders manage the exposure they have. There are more options with a €7.00 strike than any other, so this is the main battle line and will lead to a bumpy ride should prices test €7. Considering the auction shutdown and persistent cold weather, it remains hard to see why there should be further material falls for carbon in the coming week. However, the auction results last week were lacklustre as both cover ratios and clearing prices fell below recent trends, suggesting waning demand. If this trend continues prices will struggle again this week. Overall, we go into the week with a neutral outlook but expect some volatility if prices test €7.

OTHER NEWS

UK government begins process to bring forward 2018 compliance dates

The UK government has begun the process to bring forward the 2018 compliance and verification dates in UK law. The change in UK law is necessary to avoid the invalidation of UK issued allowances from 1st January, 2018 as part of a European Commission proposal to ‘protect the environmental integrity of the EU ETS’ in light of Brexit. The UK is using a statutory instrument to bring forward the dates to have the change in law in force by the end of the year. Assuming there are no delays in the process the change will be in place on 27th December, 2017 ensuring the UK is free to issue allowances as normal in 2018. Sign up to our Brexit working group to find out more details of consequences of Amendment 47 and other Brexit issues.

In case you missed our MiFID II email…

MiFID II is causing confusion for installations as the carbon market is dragged into new financial regulation – and some are spreading misplaced fear in relation to the issue. The Markets in Financial Instruments Directive (MiFID) II is a revision of the original MiFID regulation that sought to increase transparency and remove cross-border barriers in the cash equity markets. MiFID II will extend this legislation to cover anyone trading financial instruments. Normally spot markets are not financial instruments but in response to fraud in the carbon markets in 2009 and 2010 the European Commission decided that a spot settled EUA (or a CER used for EU ETS compliance purposes) should be defined as a financial instrument.

Read more about why you probably don’t need to worry about MiFID II on our website… Or feel free to contact Redshaw Advisors on +44 203 637 1055 if you have any further questions.